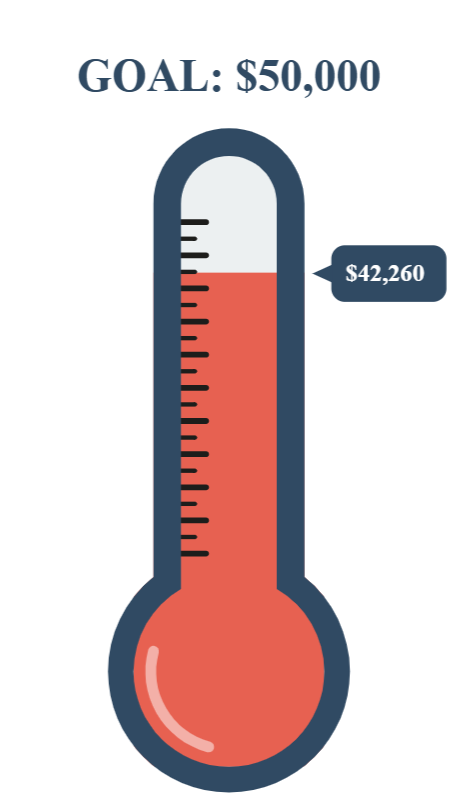

Help us unlock $50,000 by making a noncash gift!

Your noncash gift will be matched dollar for dollar up to a total of $50,000 from an anonymous donor.

Noncash gifts are often the most tax advantageous way to give. If you’re unfamiliar with the tax benefits provided by these gift types, talk with your professional advisor.

Match Qualifying Gift Types

Gifts of Stock

Donating appreciated securities, such as stock, bonds, or mutual funds to LCHS allows you to bypass capital gains tax AND still deduct the full fair market value at the time of the gift.

IRA Contributions

If you are 70 ½ or older, you can direct a tax-free qualified charitable distribution to LCHS from your IRA. After age 73, this type of distribution satisfies your RMD.

Donor-Advised Fund Distributions

Advise your DAF administrator to direct a distribution to LCHS.